Stuffing It Under the Mattress

There’s a cartoon making the rounds that shows a picture of the White House with a sign on the front lawn reading “The White House: A subsidiary of Goldman Sachs”. It would have been a perfect image to accompany Matt Taibbi’s “The Great American Bubble Machine” that appeared in Rolling Stone early in the summer.

Taibbi’s piece covers 80 years of financial malpractice and manipulation and begins by drawing heavily from John Kenneth Galbraith’s The Great Crash, 1929 (1955), a book that can be found in most libraries and many respectable second-hand or antiquarian book shops. In one of the chapters, entitled “In Goldman, Sachs We Trust” (sic), Galbraith explains in some detail how the Shenandoah and Blue Ridge “investment trusts” operated as leveraged Ponzi schemes to benefit the few at the expense of a financially naïve public. The abuses of the investment banks that resulted in the first Glass Steagall Act of 1932 (until its repeal in 1999 during the second Clinton administration), gave a certain amount of protection for savers and small retail investors. And as this is being written, Rolling Stone is about to publish another longish piece by Taibbi (that he spent a year researching) which investigates the role of naked short selling and other financial trickery in the downfall of Lehman Brothers—think of Taibbi as Upton Sinclair with a better sense of humor. Lately, it seems, a lot of interesting comment on the subject has been appearing in a magazine that tries to give the impression its targeted audience is made up largely of teenagers on pot. I don’t think the mainstream financial press likes Taibbi very much.

(If you don’t have a copy of Rolling Stone, you can poke around and easily find the article on the Internet, which gives you some idea of the direction periodical publishing is headed. I suspect that in the end, we’re all paper dinosaurs teetering on the edge of the digital tar pit, so why, you might ask, subscribe to anything when you can pick up free samples somewhere or read content on the Internet? Many of us have a romantic attachment to and claim to have a personal preference for print media, but while printing and mailing expenses increase year after year, the cost of digital storage on remote servers continues to drop. Just do the math. But I digress.)

In an interview with Gillian Tett in the September 25-26 weekend edition of the Financial Times , English playwright and social critic David Hare discusses his new play The Power of One (subtitled “a dramatist seeks to understand the financial crisis”) which by the time you read this will have opened at London’s Royal National Theatre. Before writing the play Hare says he read from 40 to 50 books on the subject and he tells the interviewer “I think the fundamentalist ideas about the free markets have been pretty discredited. For the past few years there has been this idea that if two people make a deal in their self-interest and somebody got burnt, then it didn’t matter because it was their own stupid mistake... but we now know that damage from that does not just affect two people but lots of other people too...”

Coincidental with a general distrust of investment banks and investment bankers is a healthy economic trend towards paying down debt and adopting more sensible spending habits—in short, following the principles preached but, unfortunately, not practiced by Wilkins Micawber. And now that the banks are paying little or no interest on savings (while at the same time increasing interest rates and fees charged on credit card balances), the general distrust is turning to disgust and there’s a long overdue consumer revolt underway. Investment bankers call this an “ugly deflation”. Others call it good news.

We noticed at this year’s Madison-Bouckville summer antique show, the largest outdoor antique event in New York State, that there was more activity than in previous years and more cash than usual seemed to be changing hands. With all the uproar about the tricky overdraft charges on debit cards (the banking method most favored by people less likely to keep a tight rein on their finances), the trend seems to be increased use of cash—or credit cards by people able to pay their balances in full every month. In case you’ve been away on extended holiday, the overdraft scandal that has been widely reported and commented on has to do with sophisticated software used by many banks who automatically give overdraft protection to their customers for a hefty fee, often $25.00 to $35.00 per overdraft transaction. This means that if you have $100.00 in your account and make 9 consecutive debit card payments totaling $90.00, but later the same day make another one for $101.00 or more, the bank can automatically re-order the timing of electronic payments, debiting the last one from your account before the first nine. This will result in ten overdraft fees rather than one—or $350.00 rather than $35.00). Nice! As Onslow would say.

As suggested earlier, I think the sea change in the way banks do business, is bringing about a corresponding shift in the way more people relate to banks. At the Madison-Bouckville outdoor show this past August I observed that not only was more cash in evidence, but there seemed to be a lot more buying and selling between exhibitors and show visitors.

One of the instances that sticks in my mind has to do with postcard ephemera. A postcard collector/dealer (someone who deals on the side to support his habit, like some folks who engage in independent pharmaceutical research) made the rounds of the lower end, flea market-type vendors, and bought very well. In this case he bought postcards priced at $1.00 which he turned over the same day to specialist postcard dealers for $8.00 each. I have no idea how many postcards he bought and sold, but comparing his rate of return to the return on money invested in a savings account or money market instrument stirs the imagination. Of course he could have kept, for example, $100.00 in a savings account where he might have been able to earn as much as ½% or 50¢ per annum. Assuming he spent $100.00 on postcards (assumptions are always a problem in any comparison) his return that day would have been about $700.00 or 700%—on a 30-day yield or annualized basis, the rate of return would be truly staggering. I’m not suggesting or pretending that this pace of trading could have been sustained for very long, but am only describing what I saw—and whether this indicates any sort of trend remains to be seen.

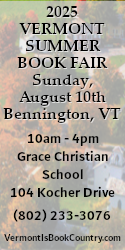

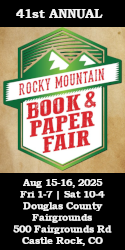

This type of trading (selling up the food chain) has been going on for as long as there have been antique shows, antiquarian book fairs, or flea markets, but it just seemed more apparent this past August. In many situations cash can be a powerful tool with a great deal of leverage—if nothing else it avoids the usurious interest rates charged by credit card companies, and when the choice is between allowing others to mismanage their money or trying their hand at mismanaging it themselves, I suspect more people are thinking that if they do screw up they have only themselves to blame. And since they’re not too big to fail, unlike the Nicely Nicely Johnsons of the investment banking world, they probably won’t get a taxpayer-financed bailout.

Cash stuffed under the mattress doesn’t earn any interest, but for all practical purposes it doesn’t earn anything when it’s deposited in a savings account either. The money the collector/dealer spent on postcards at the Bouckville show this past summer could have been from cash kept on hand for the purpose, in which case it earned returns (percentage-wise) that would make an investment banker sit up and take notice.

Some years ago I asked a stock broker where he invested his money and was both blindsided and amused when he admitted “mostly in groceries” (Now there’s an honest broker for you!). Business must have been bad that year, but I think there’s a point, albeit an obvious one, to be made. In uncertain economic times people tend to get back to basics—for some of us it’s food and shelter for the body, good books for the mind and spirit. For other folks it might be t.v. Talent shows, spectator sports or video games (circuses to go along with their bread), but in either case people with ready cash on hand and no outstanding consumer debt will have the advantage.

Website Changes

If you haven’t visited our website lately (www.booksourcemagazine.com), you should have another look. The improvements we talked about last time are now in place. Until late in September, updates were made only infrequently—a day or two after the general mailing of our print edition. The look of the home page has changed—the first thing you’ll see is the Book Fair Calendar, immediately followed by the Book Auction Calendar and Book News and Notes—all on the home page (with vertical scroll bars) so users can read the three columns in full, without having to navigate to another page. Any of the three are accessible in the usual way by using the links bar at the top of the page. But an even more important improvement is that rather than being revised every month or so, the events calendars will be updated as often as needed—every week, every day or every hour—depending on how fast we gather the information.

Also, as a reader of this magazine, chances are you either belong to a book club or at least know someone who does. One of the most under-used features on our website, on the verge of possibly being eliminated, is “Maricela’s Book Club” (named after our daughter who suggested the idea), where book club members can post details of their next meeting, comment on recent selections, and/or check out what others are reading. If you’re a book club participant and think the feature has some merit and should be continued, you can influence our decision by visiting the website, clicking on the book club link, and using the free service being offered.